Bridging the Health Insurance Gap: Understanding Knowledge, Attitudes and Enrolment Determinants among Informal Sector Workers in Osun State, Nigeria

Main Article Content

Abstract

Background

Health insurance is a risk-pooling mechanism to mitigate catastrophic healthcare costs and reduce out-of-pocket spending, which correlates with poverty. In Nigeria, the informal sector constitutes about 58.2% of the economy. Thus, high enrolment in this sector would protect a significant portion of the population from catastrophic health expenses. This study aims to assess the perceptions and determinants of enrollment in the Osun State Health Insurance Scheme (OHIS) among different occupational groups within the state’s informal economy.

Methods

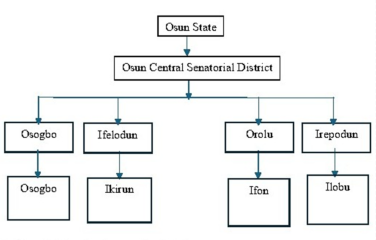

This descriptive cross-sectional study used a multi-stage sampling technique to recruit 390 participants from the informal sector, using a self‑designed, pretested, interviewer‑administered questionnaire. Data were analysed using IBM SPSS Statistics version 20. The chi-square test and logistic regression were used to determine associations between categorical variables, and the level of significance was set at 5%.

Results

This study comprised predominantly males (53.8%), with a mean age of 37.35 ± 11.80 years. Despite high awareness (65.9%), overall knowledge of the health insurance scheme was poor (76.2%). Enrolment rates were low (10.5%), most respondents exhibited unsupportive attitudes (76.2%) and negative perceptions (93.1%). However, 49.5% expressed willingness to enrol. Supportive attitudes and good knowledge significantly influenced enrolment status (AOR: 6.654 and 4.394, respectively).

Conclusion

This study indicates that enrolment status in the informal sector was significantly associated with attitudinal, cognitive, demographic, and economic factors. To enhance enrollment rates, the implementation of comprehensive educational initiatives is recommended to increase awareness and understanding of health insurance schemes .

Downloads

Article Details

This work is licensed under a Creative Commons Attribution 4.0 International License.

This work is licensed under a Creative Commons Attribution 4.0 International (CC BY 4.0) license. To view a copy of this license, visit https://creativecommons.org/licenses/by/4.0/.

How to Cite

References

Alawode GO, Adewole DA. Assessment of the design and implementation challenges of the National Health Insurance Scheme in Nigeria: a qualitative study among sub-national level actors, healthcare and insurance providers. BMC Public Health. 2021;21(1):1–12.

Erinoso O, Oyapero A, Familoye O, Omosun A, Adeniran A, Kuyinu Y. Predictors of health insurance uptake among residents of Lagos, Nigeria. Popul Med. 2023;5(July):1–7.

International Labour Organization. Informal Economy. ILO. International Labour Organization; 2024.

Bolaji S. Informal sector key driver of economic growth - Oyetola. Punch Newspaper. 2022.

International Labour Organization. More than 60 per cent of the world’s employed population are in the informal economy. 2018.

Onasanya AA. Increasing health insurance enrolment in the informal economic sector. J Glob Health. 2020;10(1):1–5.

Aregbeshola BS, Khan SM. Out-of-pocket payments, catastrophic health expenditure and poverty among households in Nigeria. Int J Heal Policy Manag. 2018;7(9):798–806.

World Health Organization. Universal Health Coverage (UHC). World Health Report. 2023.

World Health Organization. Trends in financial hardship due to out-of-pocket health spending in the WHO African Region [Internet]. WHO Webpage. 2024 [cited 2024 Dec 12]. p. e1-5. Available from: https://www.afro.who.int/sites/default/files/2024-12/Regional brief_v5.pdf

Adenekan A, Ekpenyong J, Carlson A, Sine J, Ilika F. Health Financing Landscape: Osun State, Nigeria. Palladium, Health Policy Plus. Washington DC; 2020.

Osun Health Insurance Agency. OHIS [Internet]. OHIS Webpage. 2024 [cited 2024 Nov 11]. p. e. Available from: https://oshia.ng/

Charan J, Biswas T. How to calculate sample size for different study designs in medical research? Indian J Psychol Med. 2013;35(2):121–6.

Osunde NR, Olorunfemi O, Oduyemi RO. Awareness, willingness, and challenges of the informal sector toward state National Health Insurance Services in Benin City, Nigeria. MGM J Med Sci. 2023;10(1):30–7.

Adewole DA, Adebayo AM, Udeh EI, Shaahu VN, Dairo MD. Payment for health care and perception of the national health insurance scheme in a rural area in Southwest Nigeria. Am J Trop Med Hyg. 2015;93(3):648–54.

Adewole DA, Akanbi SA, Osungbade KO, Bello S. Expanding health insurance scheme in the informal sector in Nigeria: awareness as a potential demand-side tool. Pan Afr Med J. 2017;27:e52.

Campbell PC, Owoka OM, Odugbemi TO. National health insurance scheme: Are the artisans benefitting in Lagos state, Nigeria? J Clin Sci. 2016;13(3):122–31.

Wang P, Li S, Wang Z, Jiao M, Zhang Y, Huang W, et al. Perceptions of the benefits of the basic medical insurance system among the insured: a mixed methods research of a northern city in China. Front Public Heal. 2023;11.

Olowookere P, Tajudeen W. Bridging the Health Insurance Gap: Understanding Knowledge, Attitude and Enrolment Determinants among Informal Sector Workers in Osun State. [Internet]. Zenodo; 2024. Available from: https://doi.org/10.5281/zenodo.14395165

Yusuf HO, Kanma-Okafor OJ, Ladi-Akinyemi TW, Eze UT, Egwuonwu CC, Osibogun AO. Health Insurance Knowledge, Attitude and the Uptake of Community-Based Health Insurance Scheme among Residents of a Suburb in Lagos, Nigeria. West Afr J Med. 2019;36(2):103–11.

James N, Acharya Y. Increasing Health Insurance Enrollment in Low- and Middle-Income Countries: What Works, What Does Not, and Research Gaps: A Scoping Review. Inq (United States). 2022;59.

Mohammed S, Aji B, Bermejo JL, Souares A, Dong H, Sauerborn R. User experience with a health insurance coverage and benefit-package access: Implications for policy implementation towards expansion in Nigeria. Health Policy Plan. 2016;31(3):346–55.

Nsiah-Boateng E, Prah Ruger J, Nonvignon J. Is enrolment in the national health insurance scheme in Ghana pro-poor? Evidence from the Ghana Living Standards Survey. BMJ Open [Internet]. 2019 Jul 1;9(7):e029419. Available from: https://bmjopen.bmj.com/lookup/doi/10.1136/bmjopen-2019-029419

Kofoworola AA, Ekiye A, Motunrayo AO, Adeoye AT, Adunni MR. National Health Insurance Scheme: An Assessment of Service Quality and Clients’ Dissatisfaction. Ethiop J Health Sci. 2020;30(5):795–802.

Barasa E, Rogo K, Mwaura N, Chuma J. Kenya National Hospital Insurance Fund Reforms: Implications and Lessons for Universal Health Coverage. Heal Syst Reform [Internet]. 2018 Oct 2;4(4):346–61. Available from: https://www.tandfonline.com/doi/full/10.1080/23288604.2018.1513267

Will M, Groeneveld J, Frank K, Müller B. Informal risk-sharing between smallholders may be threatened by formal insurance: Lessons from a stylized agent-based model. Sarker MNI, editor. PLoS One [Internet]. 2021 Mar 19;16(3):e0248757. Available from: https://dx.plos.org/10.1371/journal.pone.0248757